Tips to prevent iPhone users from losing money during mobile payments

This article has Tips to prevent iPhone users from losing money during mobile payments. Smartphones have made life easier. It is changing the way we shop and buy things, mobile payments are faster and easier, it has become the norm.

However, mobile payment security concerns have informed us.

- Recently, some iPhone users in China lost money due to flaws in Apple’s login system.

- Chinese iPhone users are complaining that their money has been stolen from online payment services after cyber attackers attacked their Apple accounts.

- Hundreds of people are claiming to be the victims of Apple ID breaches.

- Some said they had lost as much as 10 RMB (about 1,440 dollars).

Many users have uploaded screenshots of online payment notices saying, “I never bought them”. Some victims have asked Apple for compensation, but not all have been reimbursed.

Tips to prevent iPhone users from losing money during mobile payments

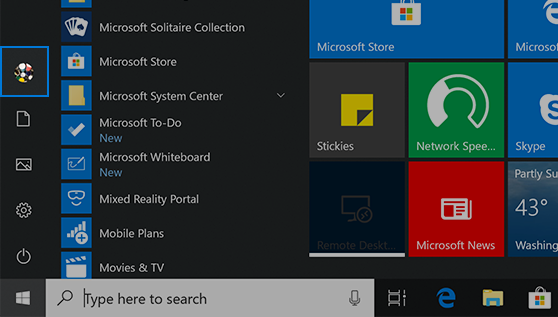

To prevent iPhone users from losing money through their online payment process, Alipay recommends all iPhone users to disable or reduce the passwordless limit for mobile payments.

- Go to the Alipay app, click ME > Settings > Payment Settings.

Alipay payment settings

- Click Auto Pay/Debit > App Store, Apple Music, and iCloud > Monthly Savings, then turn off or set a monthly limit that meets your expectations.

Turn off passwordless payments

- Although Alipay passwordless payments have opened the door for criminals, the main reason for this is ultimately due to the hacking of the user’s Apple ID account and password. If we can secure accounts properly, criminals will have no chance to steal your data and money.

- So you should be careful like using strong passwords and using different passwords for your accounts and apps and make sure you are using genuine apps instead of rogue apps.

- Additionally, you need to add a security deposit to your account. For more information, see Enable two-factor authentication for your Apple ID.

- To do this, go to Settings > iCloud. Tap Your Apple ID > Password & Security. Click Set up two-factor authentication > Continue.

- Then, follow the on-screen instructions to complete it. 2 fa configuration for Apple ID

- Once you complete two-factor authentication, you can only access your account through trusted devices. When connecting to a new device for the first time, you are asked to enter a password and verification code.

- Therefore, even if your account password is stolen, criminals cannot access your account on a new device because there is no verification code. The best mobile payment scams you should be wary of

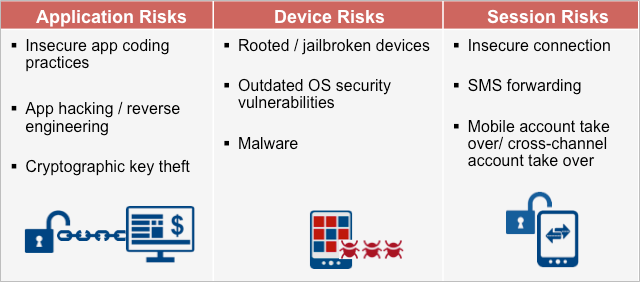

Mobile payment hacks continue to evolve.

There are many fighting areas, but the most dangerous ones we see are summarized in the table below:

The risk of paying a phone bill

- Best practices for securing mobile payment information you should know.

- Download only trusted apps

- Download mobile apps only from official app stores. Make sure phone settings are set to prevent downloading apps from unauthorized stores.

- Download only trusted apps

Use only secure and trusted payment platforms

If you plan to enter your payment information on your phone, use the software that came with your phone or a trusted payment provider.

The popular mobile payment system does not store your credit card details, which can ensure data protection and personal transactions when using the mobile app.

In-App Payments

Avoid paying phone bills on public Wi-Fi

Public Wi-Fi is always dangerous. Whenever data is sent over an encrypted network, hackers can spy on the data.

If you set up a mobile wallet, or even use a wallet while connected to Wi-Fi, hackers can access your phone and secure card.

Avoid this risk by not entering personal information on your phone when you are on a public Wi-Fi network. Or, use a VPN when connecting to an unsecured network.

Avoid paying phone bills on public Wi-Fi

If the payment transaction seems suspicious, you should consider making the payment later or in a different way.

If implemented correctly, these security measures will greatly reduce the chances of your mobile payment app being compromised. They can also prevent you from wasting vacation-related phone business benefits to pay for potential data breaches.